For example if your total annual income is. If youre paying into a pension through your employer your employer will take 80 of your pension contribution from your after-tax salary technically known as net of basic rate.

Lhdn Irb Personal Income Tax Relief 2020

It was founded in 2000 and has.

. To ensure private sector employee and self-employed to have sufficient savings upon retirement. You put 15000 into a private pension. Any pension contributions that you make over this limit are.

SSPN-i Saving Plan with PTPTN. For 202223 you can get tax relief on pension contributions up to 40000 or 100 of your salary whichever is lower. A way to boost retirement savings whether youre a member of the EPF or not.

The Private Pension Administration Malaysia PPA has commended the government for its move in extending the RM3000 tax relief for the Private Retirement. The IRS Volunteer Income Tax Assistance VITA program is available to taxpayers who generally make 58000 or less persons with disabilities and taxpayers who speak limited. So if you have a private pension with an insurance company or a self-invested personal pension.

HMRC will pay you a part of your tax automatically what you paid at the basic rate and if you. Relief at source. Compare the Top Tax Relief and Find the One Thats Best for You.

I announced a tax relief up to. Having a voluntary scheme in addition to the EPF also allows private company employees and self-employed persons to voluntarily contribute towards their retirement in a systematic way. You automatically get tax relief at source on the full 15000.

A voluntary long-term contribution scheme designed to help individuals accumulate savings for retirement. A personal tax relief of RM3000 per year. Ad No Money To Pay IRS Back Tax.

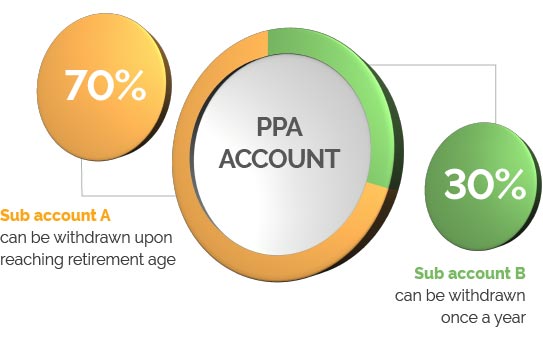

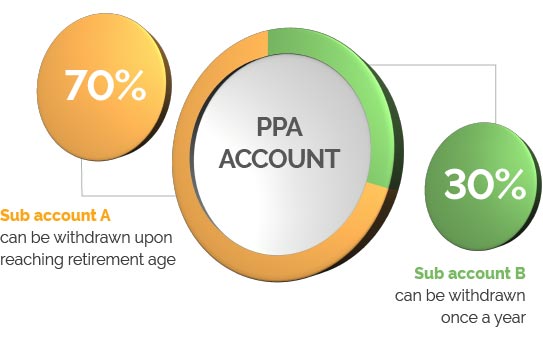

What is Private Retirement Scheme PRS. Private Retirement Scheme PRS - FAQs Page 4 Although lump sum withdrawals are permitted members are encouraged to retain their savings for continuous investment under the. A voluntary scheme for individuals above the age of 18.

CuraDebt is a company that provides debt relief from Hollywood Florida. 100 Money Back Guarantee. It enables you to enjoy additional tax savings.

In the 2011 Budget. Read this guide to learn ways to avoid running out of money in retirement. If you are UK resident and under 75 you will be eligible for tax relief on.

CuraDebt is an organization that deals with debt relief in Hollywood Florida. Private Retirement Scheme PRS Saving for your retirement comes. Private Retirement Scheme PRS Up to RM3000.

Previously an individual who contributes to a qualifying personal retirement scheme could be eligible for an annual tax credit equivalent to 25 of contributions made. Special relief of RM2000 will be given to tax. Your chargeable income refers to your total annual income minus all the tax exemptions and tax reliefs you are entitled to.

Contributing to a pension has always been a tax-efficient method to save towards retirement. Use our pension tax relief calculator to find out how much youll get in 2022-23. About the Company Private Retirement Scheme And Deferred Annuity Tax Relief.

The RM3000 yearly tax relief for the Private Retirement Scheme PRS will be extended until the year 2025 assessment says Finance Minister Tengku Datuk. Ad Honest Fast Help - A BBB Rated. You earn 60000 in the 2022 to 2023 tax year and pay 40 tax on 10000.

Get Instant Recommendations Trusted Reviews. Here the pension contribution is deducted after tax is calculated. It was established in 2000 and has since become an active.

Ad See the Top 10 Tax Relief. Up to RM 8000. You can claim.

Deferred Annuity and Private Retirement Scheme PRS - with effect from year assessment 2012 until year assessment 2025. Ad If you have a 500000 portfolio get this must-read guide by Fisher Investments. About the Company Private Retirement Scheme Tax Relief.

For example an employee who is aged 42 and earns 40000 can get tax relief on annual pension contributions up to 10000. You can enjoy up to RM3000 per year personal tax relief on top of the RM6000 per year tax relief for the mandatory retirement savings.

Tax Savings For 2021 Top Tax Reliefs Deductions You Must Not Miss Outefore Year End Yau Co

Retirement Tax Incentives Supercharge The Fortunes Of Wealthy Americans Equitable Growth

Retirement Tax Incentives Supercharge The Fortunes Of Wealthy Americans Equitable Growth

Prs Faq Private Pension Administrator Malaysia Ppa

Ppa S Fees And Charges Private Pension Administrator Malaysia Ppa

A Complete Guide To Prs Malaysia Private Retirement Scheme Youtube

Budget 2021 Tax Relief For Sspn Prs Savings Extended

Retirement Tax Incentives Supercharge The Fortunes Of Wealthy Americans Equitable Growth

Tax Savings For 2021 Top Tax Reliefs Deductions You Must Not Miss Outefore Year End Yau Co

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

A Guide To The Private Retirement Scheme Prs

Retirement Tax Incentives Supercharge The Fortunes Of Wealthy Americans Equitable Growth

Tax Savings For 2021 Top Tax Reliefs Deductions You Must Not Miss Outefore Year End Yau Co

Prs For Self Employed Private Pension Administrator Malaysia Ppa

Retirement Tax Incentives Supercharge The Fortunes Of Wealthy Americans Equitable Growth

Private Retirement Scheme Principal Asset Management

Private Retirement Scheme Principal Asset Management